Research:

-http://www.huffingtonpost.com/diann-rusttierney/publics-changing-attitude_b_4220254.html

-http://www.people-press.org/2001/03/21/interdiction-and-incarceration-still-top-remedies/

-http://www.economist.com/news/united-states/21583701-america-waking-up-cost-mass-incarceration-unlikely-alliance-left-and

Monday, December 2, 2013

Tuesday, November 26, 2013

Page One: The New York Times

One of the most interesting things to me in "Page One The New York Times" was the decline of print media. I had no idea that ad revenues had declined so much over the last several years. Recently former powerhouse papers like the Chicago Tribune have been forced to lay off hundreds employees in an attempt to remain profitable. In fact the valuations of major papers has plummeted throughout the last decade. This trend started with the advent of the internet but was accelerated by the Great Recession which caused ad revenue to plummet. The New York Times has attempted to change its business model away from a reliance on ad revenue and instead make the company reliant on subscribers dues. A key part of this is making their website open only to scribers. However, this has only had limited success. One paper that has managed to be successful in the digital age is the Wall Street Journal. The Wall Street Journal has avoided this by always allowing only subscribers access to its' website, increasing its subscriber base, and increasing its ad growth.

http://en.wikipedia.org/wiki/The_Wall_Street_Journal#Design_changes

http://www.forbes.com/sites/afontevecchia/2013/11/20/tribune-co-cutting-700-newspaper-jobs-amid-dropping-advertising-revenues/

http://www.cnbc.com/

https://d28wbuch0jlv7v.cloudfront.net/images/infografik/normal/ChartOfTheDay_596_advertising_rev

enue_of_U_S_newspapers__n.jpg

http://rack.0.mshcdn.com/media/ZgkyMDEzLzAyLzA3LzI5L255dGltZXMuNjdmNWIuanBnCnAJdGh1bWIJOTUweDUzNCMKZQlqcGc/f50d6b91/693/nytimes.jpg

http://en.wikipedia.org/wiki/The_Wall_Street_Journal#Design_changes

http://www.forbes.com/sites/afontevecchia/2013/11/20/tribune-co-cutting-700-newspaper-jobs-amid-dropping-advertising-revenues/

http://www.cnbc.com/

https://d28wbuch0jlv7v.cloudfront.net/images/infografik/normal/ChartOfTheDay_596_advertising_rev

enue_of_U_S_newspapers__n.jpg

http://rack.0.mshcdn.com/media/ZgkyMDEzLzAyLzA3LzI5L255dGltZXMuNjdmNWIuanBnCnAJdGh1bWIJOTUweDUzNCMKZQlqcGc/f50d6b91/693/nytimes.jpg

Thursday, November 14, 2013

Issue Post: The Media

The Media's Role in the Debate on Debt and the Financial Services Sector

The Media plays a huge role in the debate over the National Debt and the Financial Services Sector. The same topics are covered very differently by the different media organizations. Prior to the Financial Crisis there was limited discussion of increased financial regulation. However, after the Crisis prominent companies such as MSNBC, CNN, and the New York Times all came out in favor of increased regulation, while the New York Post, Wall Street Journal, and Fox News did not support additional regulations. While the New York Times would often put stories about the Dodd-Frank Bill on the front page, the Wall Street Journal would place it on page 8 of the Money&Investing section. MSNBC hosts such as Rachel Maddow said increased regulation would help prevent future busts. While Fox New's anchors like Sean Hannity said it would limited the profitability of financial services firms and slow economic growth. When covering the national debt the differences between the major media organizations is more nuanced. All of the major news outlets agree that something must be done. The difference is the New York Times, MSNBC, and CNN support higher taxes along with spending cuts, while Fox News/WSJ often support only spending cuts. In addition although more left leaning news sources like MSNBC say the national debt is an issue, they argue that it is not an urgent one. While Fox often states the debt must be cut to avoid a severe economic crisis.

The Media plays a huge role in the debate over the National Debt and the Financial Services Sector. The same topics are covered very differently by the different media organizations. Prior to the Financial Crisis there was limited discussion of increased financial regulation. However, after the Crisis prominent companies such as MSNBC, CNN, and the New York Times all came out in favor of increased regulation, while the New York Post, Wall Street Journal, and Fox News did not support additional regulations. While the New York Times would often put stories about the Dodd-Frank Bill on the front page, the Wall Street Journal would place it on page 8 of the Money&Investing section. MSNBC hosts such as Rachel Maddow said increased regulation would help prevent future busts. While Fox New's anchors like Sean Hannity said it would limited the profitability of financial services firms and slow economic growth. When covering the national debt the differences between the major media organizations is more nuanced. All of the major news outlets agree that something must be done. The difference is the New York Times, MSNBC, and CNN support higher taxes along with spending cuts, while Fox News/WSJ often support only spending cuts. In addition although more left leaning news sources like MSNBC say the national debt is an issue, they argue that it is not an urgent one. While Fox often states the debt must be cut to avoid a severe economic crisis.

http://www.foxnews.com/

http://www.nytimes.com/

http://en.wikipedia.org/wiki/News_media_(United_States)

http://cdn6.triplepundit.com/wp-content/uploads/2011/11/fox-news-logo.jpg

http://blogs.courant.com/curtain/Rachel-Maddow-08-NBC01.jpg

Monday, November 11, 2013

Issue Post: Special Interest Groups

Special Interest Groups and Financial Services:

Special Interest Groups play a key role in the financial services sector and other sectors. Many large banks and other financial institutions hire lobbyists to halt attempts at new regulation. Or they push for a roll back of regulations that they believe negatively affects the profitability of their companies. In 2010 many lobbyists representing the Financial Services industry lobbied Congress to oppose the Dodd-Frank Bill. They believed the bill would restrict the company from engaging in revenue generating activities and add onerous regulations. However their efforts failed and the bill was passed. In 1999 they achieved more success when the lobbied Congress to overturn Glass-Steagall. This allowed banks to once more have both commercial and investment banking. This dramatically increased profits at big banks. On a much small level some liberal lobbyists lobby for increased consumer protections and new restrictions on big banks.

http://en.wikipedia.org/wiki/Gramm%E2%80%93Leach%E2%80%93Bliley_Act

http://en.wikipedia.org/wiki/Gramm%E2%80%93Leach%E2%80%93Bliley_Act

http://www.thenation.com/sites/default/files/user/20/DoddFrank_Lobbyists_1000px-1.jpg

http://steadfastfinances.com/blog/wp-content/uploads/2011/03/Percentage-of-Too-Big-To-Fail-Lobbyists-that-are-former-Government-Employees.gif

3-2-1 Post: Lobbyist's Playbook

The Lobbyists Playbook

|

This reminded me of my Eighth Grade Economics course where we learned that bank lobbyists were attempting to halt any effort to reform Wall Street after the Financial Crisis. This lobbying scandal also reminded me that throughout history there are examples of the toxic effect of money in government. In Cuba the corruption of the Government allowed special interests to dominate the country. This inspired Fidel Castro to start a revolution and create a communist nation.

My one question is what happened to Tom Delay? After some research I found that he was forced to resign as House Majority Leader, vacate his House Seat, and he was criminally indicted. He was found guilty in 2011, but his conviction was overturned in 2013.

http://en.wikipedia.org/wiki/Tom_DeLay

http://archive.corporateeurope.org/images/protestlobby-big.jpg

http://www.opensecrets.org/news/abramoff.jpg

http://archive.corporateeurope.org/images/protestlobby-big.jpg

http://www.opensecrets.org/news/abramoff.jpg

Saturday, November 2, 2013

Post: Take the Money and Run for Office

Take the Money and Run

I learned several disturbing facts from the NPR program "Take the Money and Run for Office." I had no idea that many congressmen need to raise 10,000 to 15,000 dollars a day for their campaigns. One congressmen said that he spent around three hours a day fundraising. In addition, I had no idea it was illegal for congressmen to fundraise from their offices and that many leased space across the street. These call centers often have terrible working conditions and exist solely for the purpose of cold calling wealthy donors. The most troubling thing I learned is that Senator Feingold and others believe that the Citizens United decisions was among the worst Supreme Court rulings of all time. This story reminded me off the Gilded Age. A time when money had an inordinate amount of power in politics and the average American suffered as a result. During the summer of 2012 I volunteered with a fundraising company that handled fundraising for the RNC and I saw firsthand the amount of time that goes into fundraising. However, I had no idea the congressmen and candidates spent so much of their own time doing it. Why did the Supreme Court rule the way it did on Citizens United? The Supreme Court ruled that the 1st Amendment protected the right of unlimited donations by corporations.

I learned several disturbing facts from the NPR program "Take the Money and Run for Office." I had no idea that many congressmen need to raise 10,000 to 15,000 dollars a day for their campaigns. One congressmen said that he spent around three hours a day fundraising. In addition, I had no idea it was illegal for congressmen to fundraise from their offices and that many leased space across the street. These call centers often have terrible working conditions and exist solely for the purpose of cold calling wealthy donors. The most troubling thing I learned is that Senator Feingold and others believe that the Citizens United decisions was among the worst Supreme Court rulings of all time. This story reminded me off the Gilded Age. A time when money had an inordinate amount of power in politics and the average American suffered as a result. During the summer of 2012 I volunteered with a fundraising company that handled fundraising for the RNC and I saw firsthand the amount of time that goes into fundraising. However, I had no idea the congressmen and candidates spent so much of their own time doing it. Why did the Supreme Court rule the way it did on Citizens United? The Supreme Court ruled that the 1st Amendment protected the right of unlimited donations by corporations.

http://www.oyez.org/cases/2000-2009/2008/2008_08_205'

http://netrightdaily.com/wp-content/uploads/2013/02/american-crossroads.jpg

http://upload.wikimedia.org/wikipedia/commons/d/db/Supreme_Court_US_2009.jpg

Thursday, October 24, 2013

Issue Post: Political Parties

Political Parties

Republicans and Democrats have very different ideas on the national debt and financial regulation. Democrats believe that their should stringent regulation of the financial services sector. In their opinion, Banks should be required by law to have a certain amount of capital on their balance sheets, should not be allowed to engage in proprietary trading (Trading for profit with Bank's money), and should not be allowed to become "Too big to Fail." On the issue of National Debt Democrats believe that a balanced approach is needed. They believe tax hikes for the highest earners, closing corporate tax loopholes, modest spending cuts, and small changes to entitlement is sufficient to reduce the national debt. Republican's on the other hand have a different philosophy. They believe in light regulation of the financial services sector. They believe that the SEC should monitor illegal activities, such as insider trading, but in most cases they believe the free market should be allowed to work. Republicans strongly oppose increased regulation. On the issue of the National Debt, Republicans believe that major spending cuts, and serious reforms to entitlements are needed to reduce the national debt. Republican's do not support any attempt to raise taxes. America does have a serious problem. We tax like a small government, yet spend like a big one. The solution is not to raise taxes so that we can continue to spend like a big government. The solution is to cut spending, and decrease the role of government in our lives. One party, the Republicans adheres to this philosophy.

Republicans and Democrats have very different ideas on the national debt and financial regulation. Democrats believe that their should stringent regulation of the financial services sector. In their opinion, Banks should be required by law to have a certain amount of capital on their balance sheets, should not be allowed to engage in proprietary trading (Trading for profit with Bank's money), and should not be allowed to become "Too big to Fail." On the issue of National Debt Democrats believe that a balanced approach is needed. They believe tax hikes for the highest earners, closing corporate tax loopholes, modest spending cuts, and small changes to entitlement is sufficient to reduce the national debt. Republican's on the other hand have a different philosophy. They believe in light regulation of the financial services sector. They believe that the SEC should monitor illegal activities, such as insider trading, but in most cases they believe the free market should be allowed to work. Republicans strongly oppose increased regulation. On the issue of the National Debt, Republicans believe that major spending cuts, and serious reforms to entitlements are needed to reduce the national debt. Republican's do not support any attempt to raise taxes. America does have a serious problem. We tax like a small government, yet spend like a big one. The solution is not to raise taxes so that we can continue to spend like a big government. The solution is to cut spending, and decrease the role of government in our lives. One party, the Republicans adheres to this philosophy.

http://www.marketwatch.com/

http://www.economist.com/

http://www.cnbc.com/

Wednesday, October 23, 2013

Post: Redistricting Game

I learned several key concepts after completing the redistricting game. One of the key facts I learned is the difference between reapportionment and redistricting. When a state redraws boundaries of House Districts in a state, that is redistricting. Reapportionment is where the number of Congressional seats changes based on fluctuations in population. For example after the 2010 Census Michigan lost one congressional seat, while Texas gained four congressional seats. In the game, and in most States, State Legislatures control redistricting. Although subject to the approval of the Governor and Courts, many State Legislatures gerrymander the process in order to create districts made up voters from their party. This creates districts that are overwhelmingly made up of voters from one party, creating a polarized political environment. California has attempted to fix this problem by creating the California Citizens Redistricting Commission. This commission is made up of an equal number of Republicans and Democrats. After the Census they are tasked with fairly, logically, and non-partisanly. Many States are considering adoopting this approach to take the partisanship out of politics.

I learned several key concepts after completing the redistricting game. One of the key facts I learned is the difference between reapportionment and redistricting. When a state redraws boundaries of House Districts in a state, that is redistricting. Reapportionment is where the number of Congressional seats changes based on fluctuations in population. For example after the 2010 Census Michigan lost one congressional seat, while Texas gained four congressional seats. In the game, and in most States, State Legislatures control redistricting. Although subject to the approval of the Governor and Courts, many State Legislatures gerrymander the process in order to create districts made up voters from their party. This creates districts that are overwhelmingly made up of voters from one party, creating a polarized political environment. California has attempted to fix this problem by creating the California Citizens Redistricting Commission. This commission is made up of an equal number of Republicans and Democrats. After the Census they are tasked with fairly, logically, and non-partisanly. Many States are considering adoopting this approach to take the partisanship out of politics. http://en.wikipedia.org/wiki/California_Citizens_Redistricting_Commission

http://en.wikipedia.org/wiki/California_Citizens_Redistricting_Commission

Monday, October 14, 2013

Issue Post: Polling

Polling is key to resolving our national debt. Right now, Democrats and Republicans have two very different plans for cutting spending and reducing the national debt. The Democrats plan involves tax increases on the highest earning brackets, along with modest adjustments to entitlements. While Republicans advocate a plan that drastically cuts spending, reforms entitlements, and repeals the Affordable Care Act. Before the 2012 election, polls showed that a majority of Americans supported the Republican stance on the national debt. However, the Democrats maintained control of both the White House, and the Senate during the elections. Now in October of 2013 polls show the Republicans have lost a large amount of their credibility as a result of the debt ceiling/Government shutdown. Only in recent days as new polls have come out have Republicans signaled a willingness to compromise. The future of the Debt Crisis will be decided in the next few years by who the polls favor. If after this crisis, polls show the Democrats have a commanding lead on the issue, Republicans will be forced to compromise. If polls show the public supports the Republicans on the debt issue, prepare for major changes to Medicare, and Government spending.

http://www.cnn.com/

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/09/30/absolutely-everything-you-need-to-know-about-how-the-government-shutdown-will-work/

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/09/30/absolutely-everything-you-need-to-know-about-how-the-government-shutdown-will-work/

Sunday, October 6, 2013

Blog Post: Immigration

To become a citizen of the United States, you must follow a multi-step process. First you must apply for a green card, or visa. Then you must live in the United States for 5 years. At this point you are elgible to take the Naturalization Test and become an official US citizen. The Naturalization Exam tests your knowledge off "Be able to read, write, and speak English and have knowledge and an understanding of U.S. history and government." In the spring of 2013 after months of behind the scenes meetings, a group of eight senators (including John McCain, Chuck Schumer, Lindsey Graham, and Marco Rubio) announced they had agreed on a framework for comprehensive immigration reform. After months of negotiation the group unveiled a bill that: Increased HB-1 Visas (supported by Tech companies), a pathway to citizenship, increased border security, and Guest-Worker Program). It was praised by both sides of the aisle and the non-partisan CBO even said it would lower the deficit. On June 27, 2013 the Senate passed the bill. However, the House has refused to even take up the bill. Instead the House insists that comprehensive immigration reform would be a mistake, they believe the issue would be better addressed by a series of small bills. The House is yet to pass a single one of these bills. The Government shutdown has further delayed reform efforts, leaving the fate of the Senate bill uncertain.

To become a citizen of the United States, you must follow a multi-step process. First you must apply for a green card, or visa. Then you must live in the United States for 5 years. At this point you are elgible to take the Naturalization Test and become an official US citizen. The Naturalization Exam tests your knowledge off "Be able to read, write, and speak English and have knowledge and an understanding of U.S. history and government." In the spring of 2013 after months of behind the scenes meetings, a group of eight senators (including John McCain, Chuck Schumer, Lindsey Graham, and Marco Rubio) announced they had agreed on a framework for comprehensive immigration reform. After months of negotiation the group unveiled a bill that: Increased HB-1 Visas (supported by Tech companies), a pathway to citizenship, increased border security, and Guest-Worker Program). It was praised by both sides of the aisle and the non-partisan CBO even said it would lower the deficit. On June 27, 2013 the Senate passed the bill. However, the House has refused to even take up the bill. Instead the House insists that comprehensive immigration reform would be a mistake, they believe the issue would be better addressed by a series of small bills. The House is yet to pass a single one of these bills. The Government shutdown has further delayed reform efforts, leaving the fate of the Senate bill uncertain.

http://www.uscis.gov/portal/site/uscis/menuitem.eb1d4c2a3e5b9ac89243c6a7543f6d1a/?vgnextoid=86bd6811264a3210VgnVCM100000b92ca60aRCRD&vgnextchannel=86bd6811264a3210VgnVCM100000b92ca60aRCRD

http://politicalticker.blogs.cnn.com/2013/10/05/gop-floats-six-week-funding-and-debt-ceiling-extension/?hpt=hp_c2

http://www.bloomberg.com

http://www.marketwatch.com/economy-politics?link=MW_Nav_EP

http://blogs.reuters.com/reihan-salam/files/2012/12/rubio.jpg

http://guardianlv.com/wp-content/uploads/2013/05/immigration-reform-e1364745667867.jpg

http://blogs.reuters.com/reihan-salam/files/2012/12/rubio.jpg

http://guardianlv.com/wp-content/uploads/2013/05/immigration-reform-e1364745667867.jpg

Blog Post: Ted Talk

I was very surprised to learn that there are real differences in the makeup of a liberal personality, and a conservative personality. For example, the average liberal is significantly more open to new experiences then the average conservative. In addition, it was fascinating to learn that you are born with a predisposition to a certain ideology, children are not born as a "blank slate." However, nature is still the most important part of choosing your political ideology. Another interesting fact was that conservatives prefer loyalty and protectivness, while liberals value friendliness and creativity.

I had a personal connection with the video. Both my parents are Clinton Democrats, even though everyone else in my extended family is a staunch conservative. When I formulated my first political opinion, and supported George W. Bush in the 2004 Presidential Election my mom told me I got my political leanings from my Grandpa. Ever since I have always believed my that I was born with a predisposition to conservatism. My environment just helped to bring out the trait. I studied this same topic in my Eight grade history class. My teacher then said people are either liberal or conservative based on what interest group they fall into. He said a person's personality does not play a critical role in their voting habits. However, Jonathan Haidt disproved this theory completely.

I had a personal connection with the video. Both my parents are Clinton Democrats, even though everyone else in my extended family is a staunch conservative. When I formulated my first political opinion, and supported George W. Bush in the 2004 Presidential Election my mom told me I got my political leanings from my Grandpa. Ever since I have always believed my that I was born with a predisposition to conservatism. My environment just helped to bring out the trait. I studied this same topic in my Eight grade history class. My teacher then said people are either liberal or conservative based on what interest group they fall into. He said a person's personality does not play a critical role in their voting habits. However, Jonathan Haidt disproved this theory completely.

I had a personal connection with the video. Both my parents are Clinton Democrats, even though everyone else in my extended family is a staunch conservative. When I formulated my first political opinion, and supported George W. Bush in the 2004 Presidential Election my mom told me I got my political leanings from my Grandpa. Ever since I have always believed my that I was born with a predisposition to conservatism. My environment just helped to bring out the trait. I studied this same topic in my Eight grade history class. My teacher then said people are either liberal or conservative based on what interest group they fall into. He said a person's personality does not play a critical role in their voting habits. However, Jonathan Haidt disproved this theory completely.

I had a personal connection with the video. Both my parents are Clinton Democrats, even though everyone else in my extended family is a staunch conservative. When I formulated my first political opinion, and supported George W. Bush in the 2004 Presidential Election my mom told me I got my political leanings from my Grandpa. Ever since I have always believed my that I was born with a predisposition to conservatism. My environment just helped to bring out the trait. I studied this same topic in my Eight grade history class. My teacher then said people are either liberal or conservative based on what interest group they fall into. He said a person's personality does not play a critical role in their voting habits. However, Jonathan Haidt disproved this theory completely.

My only question is what political party does Jonathan Haidt belong to? Prior to the 2004 Election Mr. Haidt was a liberal who believed conservatism was a “Frankenstein monster.”

However, after stumbling across a book about conservatism at bookstore in New York City Mr. Haidt started a year long transition to the political center. He now identifies himself as a centrist.

http://www.washingtontimes.com/news/2012/jun/26/righteous-mind-author-haidt-conservatives-have-bro/?page=all

http://thumbs4.ebaystatic.com/d/l225/pict/121080275359_2.jpg

http://i.livescience.com/images/i/000/022/828/original/democrat-republican.jpg?1324227136

http://thumbs4.ebaystatic.com/d/l225/pict/121080275359_2.jpg

http://i.livescience.com/images/i/000/022/828/original/democrat-republican.jpg?1324227136

Wednesday, October 2, 2013

Blog Post: Amendments

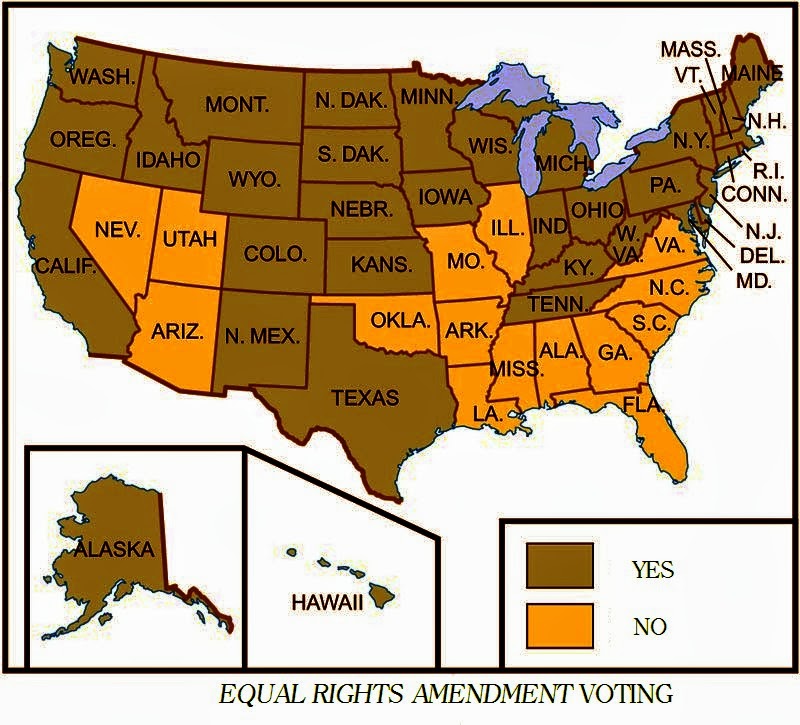

Correction: The 15 states whose legislatures have not ratified the Equal Rights Amendment are Alabama, Arizona, Arkansas, Florida, Georgia, Illinois, Louisiana, Mississippi, Missouri, Nevada, North Carolina, Oklahoma, South Carolina, Utah, and Virginia.

http://www.equalrightsamendment.org/

http://images.virtualology.com/images/5142.jpg

http://images.cpcache.com/merchandise/514_400x400_NoPeel.png?region=name:FrontCenter,id:41911605,w:16

Thursday, September 19, 2013

Issue Post: Federalism

Federalism plays a key role in both our national debt, and our financial system. Both the Federal Government and States regulate the financial industry. The Federal Government operates the SEC CFBP, FDIC. The SEC regulates the operations of banks all over the United States, as does the CFBP. The FDIC insures bank deposits for all banks across the USA. The Federal Government justifies the creation, and operation of these regulatory agencies by invoking the Commerce Clause. State regulatory agencies only regulate the operations of banks within their states. The near collapse of insurer AIG exposed some of the flaws in this system. While its Financial Products division was regulated by the Federal Government, many of its insurance subsidiaries were regulated by separate states. When losses piled up at Federally regulated AIG FP, AIG couldn't get approval to sell it's different subsidiaries fast enough from the States. This lead to a liquidity crisis that resulted in AIG being forced to take a tax payer financed bailout. On the debt front, almost all States are required in their Constitutions to have a balanced budget. Obviously, the Federal Government does not have these requirements. However in cases of fiscal emergency such as the 2008 financial crisis, the Federal Government will lend money to embattled States. The States will then follow Federal instructions on when to pay it back. Also the Federal Government will often tie grants with following new Federal Laws. This is called Fiscal Federalism. For example, when the Federal Government wanted to raise the drinking age to 21, they forced States to comply by making new highway funding dependent on raising the drinking age to 21.

Federalism plays a key role in both our national debt, and our financial system. Both the Federal Government and States regulate the financial industry. The Federal Government operates the SEC CFBP, FDIC. The SEC regulates the operations of banks all over the United States, as does the CFBP. The FDIC insures bank deposits for all banks across the USA. The Federal Government justifies the creation, and operation of these regulatory agencies by invoking the Commerce Clause. State regulatory agencies only regulate the operations of banks within their states. The near collapse of insurer AIG exposed some of the flaws in this system. While its Financial Products division was regulated by the Federal Government, many of its insurance subsidiaries were regulated by separate states. When losses piled up at Federally regulated AIG FP, AIG couldn't get approval to sell it's different subsidiaries fast enough from the States. This lead to a liquidity crisis that resulted in AIG being forced to take a tax payer financed bailout. On the debt front, almost all States are required in their Constitutions to have a balanced budget. Obviously, the Federal Government does not have these requirements. However in cases of fiscal emergency such as the 2008 financial crisis, the Federal Government will lend money to embattled States. The States will then follow Federal instructions on when to pay it back. Also the Federal Government will often tie grants with following new Federal Laws. This is called Fiscal Federalism. For example, when the Federal Government wanted to raise the drinking age to 21, they forced States to comply by making new highway funding dependent on raising the drinking age to 21.

http://www.britannica.com/EBchecked/topic/203491/federalism

http://www.slowmoneynw.org/wp-content/uploads/2013/09/us-securities-and-exchange-commission.jpg

New Yorker Article

Before reading this article in the New Yorker I did not know several basic facts in the gun debate. I had no idea there were 300 million guns in America. In the United States today there is one gun for every man, woman, and child in this country. In addition I had no idea that the NRA's main purpose used to be protecting the recreational/hunting use of the rifle. This differs significantly from today when the NRA's main purpose is protecting the 2nd amendment, and fighting gun control laws. Also, I had no idea that although there are 300 million guns in America, the amount of households owning guns has declined since the 1970s. The gun control debate reminds me of the debate over our national debt. Both sides have dug into their respective positions. There is little to no room for debate. Instead insults are hurled by both sides, and in the mean time no progress is made on either issue. The gun debate affects me personally because my cousin is Police Officer in the SFPD. He says that the prevalence of firearms in America makes his job significantly harder. He claims police work would safer, and easier if gun laws were tightened. My only question is what was the fate of recent gun control legislation in Congress. Answer: Even with President Obama's full support gun control legislation failed to pass the Senate.

http://www.gallup.com/poll/165563/remains-divided-passing-stricter-gun-laws.aspx

http://www.gunpolicy.org/firearms/region/united-states

http://www.rkbablog.com/wp-content/uploads/2013/01/Cartoon-Chicago-style.jpg

Thursday, September 12, 2013

Issue Post: Constitution

Under the Constitution, the financial sector is regulated by the executive branch of the Federal Government under Article II Section 3 of the Constitution. Although the organizations and regulations are created by Congress under Article I Section 2 of the constitution. For example during the Great Depression, Congress created the Securities and Exchange Commission. However, after it was created the executive branch has picked the Chairman of the SEC, and operated it. To justify the creation of these national financial regulatory agencies, Congress uses the Commerce Clause of the Constitution, along with the Elastic Clause. The Constitution says nothing specific about the national debt. It is neither encouraged nor denied. In recent years several prominent Republican lawmakers have voiced their support of a Balanced Budget Amendment to the Constitution. This amendment would forbid the Federal Government from running a budget deficit. This proposal has a virtually no chance of ever passing.

http://www.britannica.com/EBchecked/topic/243118/Great-Depression

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh6EJhYKCy1dwjVmrMSDuhYi744WMJ4jVrFZYs24NOuSEluEjSTdFTPkiSgTsN1jj_xW_YJdLJ84b4O8Y2qHOgM7i4JPRrAQS4zsmz4oIgRF_zES0bOxMg8SXBjZh9B-_tj5Qu-bVEw3K8/s1600/balanced+budget+cartoon.jpg

Monday, September 9, 2013

My Issue

Ever since the Debt Ceiling Crisis of the summer of 2011 I have been very interested in the financial system of the United States. For this school year I would like to focus my blog on large financial institutions, the national debt, and the real estate sector. A healthy financial sector is key to strong economic growth. The financial sector has made huge progress in recovering from the 2008 crisis, but more needs to be done. I wish to cover this on going progress, and show how the country continues to recover from the Recession. The national debt is the gravest threat this country faces. Deficits and debt have skyrocketed in the last 13 years. The Sequester, a rise in income tax rates, and stronger growth have stabilized the short, and medium term fiscal picture. However, underfunded entitlements are a major impediment to economic growth, and they cloud the long term fiscal picture. This long term debt crisis must be solved if America is to regain its former economic standing. The real estate sector interests me on a personal level. I have always been interested in construction, and the housing market. Also, the bursting of the housing bubble demonstrated the importance of the real estate sector to the national economy. A healthy real estate sector will create faster economic growth, which is very important in this time of high unemployment.

http://upload.wikimedia.org/wikipedia/commons/b/b8/US_Federal_Debt_as_Percent_of_GDP_by_President.jpg

http://upload.wikimedia.org/wikipedia/commons/b/b8/US_Federal_Debt_as_Percent_of_GDP_by_President.jpg

Monday, August 26, 2013

Introduction

My name is Peter Snow. I am a senior at St. Ignatius in San Francisco with a passion for politics. As a Republican in San Francisco I am often outspoken in debates, and usually find I am alone in most arguments. I am excited that taking AP Government will give me the opportunity to better articulate my positions on the key issues of our time. Specifically, I hope to focus on our national debt while taking AP Government. I believe that this is one of the most serious issues facing our nation. I hope that taking this course while help me to better understand the issue, and how our country got in this fiscal mess. I am also excited to learn about how legislation is crafted, and then brought to a vote in the House and Senate. I believe AP Government will further increase me interest in politics, while simultaneously helping me to better understand the issues.

Subscribe to:

Posts (Atom)

.jpg)